Making decisions concerning your retirement account is not always an easy task because what works for one person may not be the best choice for the next.

When it comes to choosing between a Roth IRA and a 401(k) account for your retirement savings, the primary concerns involved in the decision are when you expect to pay out the taxes on any contributions, and which accounts you are eligible to contribute to.

Eligibility Overview

A 401(k) account is an employer-sponsored plan and, therefore, the eligibility requirements are set by the employer. Typically, you must be aged 21 and have been with the company for at least 12 months (check with your company, some allow you to start contributing immediately) in order to qualify to contribute to a 401(k) account.

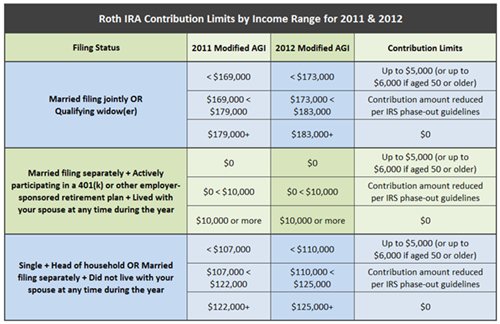

Roth IRA eligibility requirements are a bit different. Qualifications are based on the amount of income earned. Below is a table that details contribution limits and ranges for 2011 and 2012. Remember, you can contribute to your Roth IRA for 2011 until April 17th, 2012.

Taxation Overview

With a 401(k) account, you are contributing funds with pre-tax dollars, with the money being deposited into the plan directly from your pay. All contributions that you earn will be tax-free while in the account. Income tax is assessed on contributions and earnings at the time of withdrawal.

Taxes on a Roth IRA account are paid before the money is deposited. No new taxes are added while the funds are in the account or at the time of withdrawal.

Which is Right for You?

If you anticipate needing the money during your retirement for your own living expenses, you must consider what the tax rate will be in the future and whether it will be higher during the contribution years or the withdrawal years. If you count on being in a higher income bracket when you retire, the Roth IRA account may be the best choice for you, because taxes are paid now, at a presumably lower rate. Additionally, a Roth IRA account may be the right choice for you if you don’t plan to use the cash that you save for yourself, but intend to pass it to your heirs instead. A Roth IRA does not require you to take distributions at any set age.

If, during your retirement, you plan on downsizing and lowering your income, you may find a 401(k) account to be the better option. You will end up paying less taxes at the time of withdrawal since you wi’ll be in a lower tax bracket than you are currently in.

Another overall situation to consider is whether or not you may need to have access to your retirement savings at an earlier point. With a 401(k) account, early withdrawals incur stiff penalties, but a Roth IRA allows you to withdraw contributions (not earnings) penalty-free.

In most cases, if you are deciding between a Roth IRA and 401(k), a 401(k) will almost always be the best choice if you get an employer match. The additional funds that you will receive from the employer match will outweigh any difference in overall taxes paid.

For others, having both accounts may be part of the right retirement plan. If you are employed and eligible for a 401(k) account, you should not pass up the opportunity for free money, especially if your employer has a contribution-matching program. Sign up for the plan and contribute enough money as your employer will match. If you also qualify for a Roth IRA account, you can opt to put all other funds into that account for maximum retirement savings.

Leave a Reply

You must be logged in to post a comment.