Guide to Using IRS Taxpayer Advocate Services

If you’re having trouble dealing with the Internal Revenue Service (IRS), you may want to reach out to the Taxpayer Advocate Service (TAS). Every year, this program helps about 200,000 taxpayers resolve their issues with the IRS. To learn more about this service, how to get help, and what to do if you don’t qualify, keep reading.

Table of Contents

- What is the Taxpayer Advocate Services?

- What Are the Eligibility Guidelines to Use These Services?

- How to Find Your Local Advocate

- How to Request Help from TAS

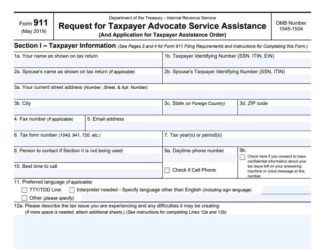

- How to Complete & Submit IRS Form 911

- Difference Between TAS and Low Income Taxpayer Clinic

- What are Alternatives to Using Taxpayer Advocate Services?

Don’t Qualify For TAS? We Can Help

What Is the Taxpayer Advocate Service?

The Taxpayer Advocate Service is a free service, designed to help individuals, business owners, and representatives from tax-exempt organizations deal with the IRS when they can’t resolve their issues using regular channels. The TAS is an independent organization within the IRS, and if you qualify for help, the TAS assigns you an advocate, argues on your behalf, and helps you submit the necessary documents to fix your issue.

In addition to helping individual taxpayers, the Taxpayer Advocate Service also looks for systemic issues. If TAS advocates notice bottlenecks or other problems repeatedly delaying the processing of tax returns, they identify potential solutions and alert the IRS to the issue so the agency can make changes as necessary.

What Are the Eligibility Guidelines to Use These Services?

Between six to 12 million people have taxes owed or issues with the IRS, and unfortunately, the Taxpayer Advocate Service can’t help everyone. The service focuses on the most serious cases, including the following situations:

- When the taxpayer is experiencing serious financial difficulties or emergencies, and if the IRS doesn’t remove a levy, release a lien, or take other steps, the taxpayer will suffer more hardship.

- When a taxpayer needs a coordinator to help them navigate through multiple steps and different units of the IRS.

- When the taxpayer has been unable to deal with the issue through the usual channels offered by the IRS.

- When the taxpayer has a unique situation, unusual legal issues, or different facts than usual.

- When a congressional office refers the taxpayer to the advocate service.

These are relatively vague categories. The advocate service looked at situations where cases tend to move successfully through the IRS, and based on that analysis; the group decided not to get involved in cases related to processing original tax returns, dealing with amended returns and working through injured (not innocent) spouse cases.

Not Eligible for TAS? See How We Can Help Get Started

When Do Taxpayer Advocates Get Involved?

In contrast, imagine a similar situation where a taxpayer has submitted an amended return for the same tax year as above, and they have also been waiting several months for a response. However, this taxpayer owes a taxes owed from the previous year, and they are getting collection warnings from the IRS. If the IRS processes the amended return, the refund can cover the taxes owed and relieve the taxpayer from financial difficulties. In this situation, the advocate service may get involved to expedite the issue and help the taxpayer avoid collection activity related to the old taxes owed.

How to Find Your Local Advocate

To find a taxpayer advocate in your area, check out the IRS’s map and click your state. Highly populated states such as New York and California have offices in multiple cities throughout the state, but in most areas, there is only one office in the state. In some cases, the office is in the capital city — for instance, in Colorado, the local TAS office is in Denver. But in other areas, the office may be in another city — for example, the TAS office in South Dakota is in Aberdeen.

How to Request Help from TAS

If you want help from the Taxpayer Advocate Service, you need to connect with your local TAS office. If you don’t have an office near you, consider reaching out over the phone. When you click on your state on the IRS’s interactive map, you receive the addresses of TAS offices in your state as well as the local and toll-free numbers for every office.

Alternatively, you can also call the TAS national office at 1-877-777-4778 for more details. If you prefer to reach out through the mail, fill out IRS Form 911 (Request for Taxpayer Advocate Service Assistance).

How to Complete IRS Form 911

Note the tax year or period related to your issue. For instance, if you’re requesting an advocate to help with an income tax issue, you should note the tax year, but if you’re dealing with an employment tax issue, you should specify the quarter related to your concern. Also, provide a written description of the tax issue and the type of relief you want.

For best results, you may also want to mention how you tried to resolve the issue on your own and list any IRS offices you’ve contacted in the past. When explaining your problem, keep in mind that the TAS doesn’t respond to “frivolous” issues. In particular, if you use this form to argue about the validity of taxes in general, you may be subject to a $5,000 fine.

You don’t have to fill out the second page of the form, Section III (Initiating Employee Information). The IRS completes this section to assess if you need additional help from the advocate service. The final two pages are just instructions including information on where to submit the form.

Where to Submit Form 911

Once you complete the form, you can take it directly to your local TAS office or fax or mail it to your local office. Again, all the contact details for local offices are available at the above link. If you are out of the country, mail Form 911 to Taxpayer Advocate Service Internal Revenue Service, PO Box 11996, San Juan, Puerto Rico 00922 or fax the form to 1-855-818-5697.

Typically, you should get a response fairly quickly about whether or not the service is willing to work with you. If you don’t hear anything within a week, you should reach out by calling the local office or the national number for the Taxpayer Advocate Service.

Difference Between Taxpayer Advocate and Low Income Taxpayer Clinics

A low-income taxpayer clinic (LITC) is an organization that helps low-income taxpayers and people who speak English as a second language (ESL) deal with the IRS. Unlike the Taxpayer Advocate Service, these organizations are not tied to the IRS at all, but they do receive matching grants from the IRS.

As the Taxpayer Advocate Service, low-income taxpayer clinics also offer their services for free, but in some cases, these clinics charge a small fee. However, you can only work with a low-income clinic if your income is under a certain threshold. In contrast, the taxpayer advocates don’t take into account your income — instead, as explained above, they look at the complexity of your tax situation and how it is affecting you financially.

What are Alternatives to Using Taxpayer Advocate Services?

Request a Free Tax Analysis & Consult Get Started

If you don’t qualify to use the Taxpayer Advocate Service, you may want to check out a low-income taxpayer clinic, but if your income is too high to be eligible for those services, you should reach out to a taxes owed specialist.

Tax liability attorneys, enrolled agents, and Certified Public Accountants (CPAs) can all help you deal with the IRS. Depending on your situation, they can help you mitigate disputes, amend your return, apply for relief on fees and interest, work out a tax settlement, set up payments, and more. Although these professionals assess a fee for their services, they usually end up saving you money in the long run. To learn more, contact us today to talk about your tax troubles.