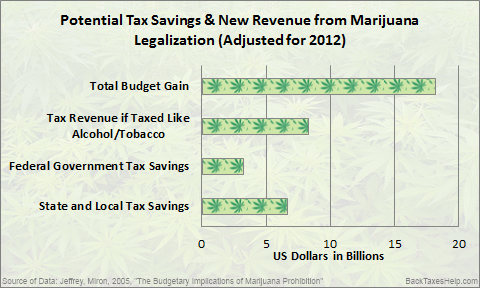

Uruguay is one country that is very close to legalizing marijuana. Political leaders in Uruguay believe the legalization of marijuana will result in less violence, tax savings, and new revenue. The idea of legalizing marijuana though in the United States has been growing in support since the 1970s. Last year Gallup showed half of Americans supported legalizing cannabis. There have been multiple scholarly papers and news articles written about how much the Federal, State, and local governments would benefit financially from legalizing marijuana and taxing it. It is obvious government revenue would increase, and enforcement related costs would decrease. But, about how much are we possibly talking about? We analyzed two popular economists papers on estimated marijuana savings and new tax revenue and adjusted for inflation as to what these number might look like in 2012. How much would legalization help state budgets? One of the most popular papers was written by Jeffrey Miron, an economics professor at Harvard University.1 It had strong support with over 400 economists undersigning it (3 Nobel Laureates) in a letter to President Bush in 2005. The numbers are not dramatic but with a national deficit of 16 trillion and growing, anything that improves our finances is something that needs to be considered, especially if it gives more freedom to the people. All forms of government would realize cost savings according to the study (and most estimates are conservative). Miron estimates that state and local governments would save around $5.3 billion a year, and the Federal government would save around $2.4 billion (based on 2003 numbers). Adjusted for inflation, those numbers today would represent $6.64 million and $3 billion respectively.2

Don’t forget, new taxes would bring new revenue. If Cannabis was taxed as other goods it would yield $2.4 billion annually. If it was taxed like alcohol and tobacco (with a modest sin tax on top of general taxation), it would yield $6.2 billion annually (which Miron bases off of numbers from 2000 and he does not adjust for inflation). Not adjusting for inflation here is important I believe–see the analysis I did on prices from August 2008-August 2012 (see chart here). Combining new tax revenue (assuming it is taxed as alcohol and tobacco) with potential savings across all levels of government would sum to almost $16 billion ($15.84) in today’s dollars (see chart above).

Could Tax Revenues Be Up to $100 Billion

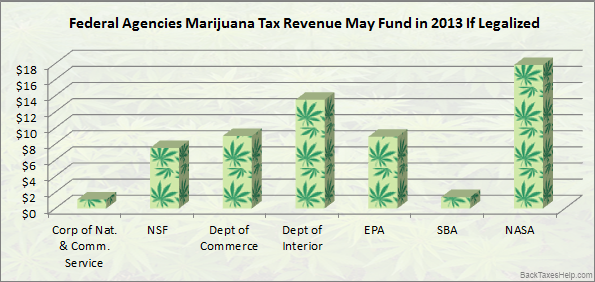

Stephen Easton, a professor of Economics at Simon Fraser University, wrote in 2010 that the revenue numbers could be between 40 billion to 100 billion3. If the government set a tax equal to the difference between the production cost and the street price, the “the government can transfer revenue from organized crime and other small producers to itself by taxing a legal product to the level consumers have already revealed they are willing to pay.” 4 Remember, if marijuana were legalized, production costs would eventually fall, which would make the tax revenue increase further (with superior production techniques as seen in the tobacco industry). Here are few Federal Department budgets tax revenue alone would pay for in 2013 if we assume the Federal Government would get 60% of 100 billion (40% to states and local municipalities):

Millions In New Revenue Will Help States More Than the Federal Government

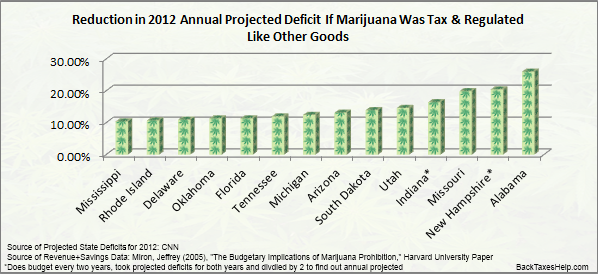

Even if we go with Miron’s modest estimate on tax revenue (assuming it is only taxed like other goods with the absence of a sin tax), when coupled with enforcement savings, the reduction in red ink is quite large for some states. If marijuana had been legalized from the start of 2012, these states would have lowered their projected 2012 deficits5 by double-digit percentages:

29 other states see a reduction of under 10%. However, what is interesting is that Arkansas, Alaska, West Virginia, and Montana, would end up with surpluses for 2012. Some of these numbers may be larger or smaller when actual budget numbers get reported next year. Legalizing marijuana through regulation and taxation, would minimally help the US Federal Government but would have a much bigger impact on state budgets. Of course, there are other factors and costs that must be considered within the marijuana legalization debate.

1 Miron, Jeffrey (2005), “The Budgetary Implications of Marijuana Prohibition,” Harvard University Paper

2 Bureau of Labor Statistics Calculator (https://www.bls.gov/data/inflation_calculator.htm)

3 https://www.businessweek.com/debateroom/archives/2010/03/legalize_marijuana_for_tax_revenue.html

4 Stephen, Fraser (2004), “Marijuana Growth in British Columbia,” Fraser Institute

5 https://www.cnn.com/interactive/2011/02/politics/table.state.budgets/

I can’t understand math or political gibberish. $20.00 for 20 decent THC marijuana ciggarettes in different varieties ( creeper, energy, relax ) would go over perfectly. people caught growing their own ( Tax Evasion ) would still be arrested ( no fly overs needed ). aside from me ( I don’t consume marijuana ) any other user won’t answer this by these stipulations because of cannabis oppression which is ignorant predjudice. hopefully cannabis ( a non addictive substance ) can one day replace both alcohol & tobacco.

Legalizing it without taxation could generate even more indirect revenue from employment and savings from end of prohibition than taxing it would.

Bootlegging and black market sales would continue, laws and law enforcement resources and attendant costs would then be back in play. You are doing it wrong.

Never mind the moral hazard that the government’s already exposed to through lottery and tobacco taxes. The state shouldn’t profit off of bad habits. (Lotto is a tax on the poor and the stupid…If Big Tobacco is accused of getting rich off of blood money with a profit of .20 per pack, how is it we aren’t guilty with profits in some locales as high as 2$ per pack? Etc…)

You really don’t spend a lot of time around people do you, Nor understand government too well.

I always have to scoff at these “legalize marijuana, then tax it!” arguments for one simple reason: they’re utterly ignorant of what everyone else already knows, namely, that marijuana is called weed for a reason– it’s a WEED.

Meaning, it will grow absolutely everywhere, in the quantities needed for personal consumption.

This isn’t like growing tobacco, with its farm-intensive economies of scale. Nor is it like running a home still, with all the possible dangers (and lack of quality control).

Yes, there will be smokers who will pay SOME money for the convenience of being able to run down to the store to buy pre-packaged marijuana, or sample other varieties. Many, if not most, people will simply grow their own stash at home, especially when confronted with any serious taxation.

People are kidding themselves if they don’t think that the largest market for marjiuana will continue to be people who *have already demonstrated* their comfort with evading the law.

Likewise, People making this argument obviously don’t appreciate how *inexpensive* it is to grow marijuana versus what a state-taxed scheme would charge. We’d have as much luck taxing people growing parsley in their herb gardens. What kind of intrusive tax regime would the American people support to do *that*?

Legalizing the possession (small scale) for personal use without legalizing the sale (or barter) of marijuana would deprive supporters of their Big Government solution.

I believe that a lot of people have entered this argument for the wrong reasons.

How much would legalizing prostitution bring in?

With special higher rates for child prostitutes?

What about contract murders? If we ‘decriminalized’ murder couldn’t we save money on prison space AND make money on top of it?

Really? Why should the determining factor of whether something is legal or not (or is ‘moral’ or not) be based on whether government can make money off of it?

NO TAX ON MARIJUANA UNDER ANY CIRCUMSTANCES! Either legalize it, or don’t, but don’t do it for a payoff. If marijuana is as benign as proponents claim, then it doesn’t require any government regulation.

Exactly my point. Looking at the financial side of moral questions is how we got slavery.

And why just cannabis? Right now I’ve got a pain in my shoulder crying out for codeine. Why do I have to do backflips to get good painkillers from my doctor? Why can’t I buy Tylenol 3 OTC here like I could in Canada?

Pot ain’t the only drug out there.

The irony here is that the government prohibits the plant because it doesn’t want people to smaoke it. There are SO many commercial and industrial applications for the hemp plant and none of these can be exploited because the plant is illegal. So the only benefit we receive as a society is… people smoke it.

Popular Mechanics proclaimed in the mid 1930’s that hemp would be the next billion dollar crop with the advent of mechanized harvest and processing equipment.

Hell, if we had fields of hemp growing it would cross pollinate with peoples outdoor marijuana rendering it all but worthless as high-end pot.

We could fund the entire planet by taxing oxygen.

Mar-J’wan? make the country money? I don’t have time for idiot blather and care less for stupidity. Why even try to keep a straight face with such absurd and idiotic articles? God, we’ve lost every vestige of common sense in America!! where’sthebeef