Owing back taxes to the IRS can be an overwhelming and stressful situation, particularly if you’re facing fines, penalties or liens. The IRS created the Fresh Start Program in 2011 in an effort to aid struggling taxpayers to resolve their back tax issues. The program has since been expanded, resulting in more help to taxpayers and a reduced need for collection actions.

How the Fresh Start Program Works

The primary goal of the Fresh Start Program is to increase the recovery of unpaid taxes while helping taxpayers avoid an unnecessary financial burden. Specifically, the program is designed the lower the number of taxpayers subject to liens. There are two primary options for dealing with back taxes owed under the Fresh Start Program. The first is the Offer in Compromise (OIC), which allows individuals and business owners to negotiate a settlement of their taxes owed for less than what’s owed. Whether or not you’ll qualify for an Offer in Compromise depends on the amount of liability you owe, your assets and your income. The IRS accepts roughly 25% of all applications for Offer in Compromise.

If your application is rejected, your other option is to set up an installment agreement. Through an installment agreement, you can make monthly payments to your outstanding taxes owed but penalties and interest will continue to accrue until the balance is paid in full (Details on how to file for an installment agreement). As of 2013, individual taxpayers can apply for an installment agreement if their total tax liability is less than $50,000. All installment agreements must be completed within 72 months and you comply with all payment and filing requirements. Small business owners who owe less than $25,000 in back taxes can apply for an In-Business Trust Fund Express Installment Agreement (IBTF-Express IA), which must be completed within 24 months.

Revisions to the Program

In 2012, the IRS announced several key changes to the Fresh Start Program which were designed to streamline the process and help taxpayers resolve their liability at a faster pace. Among the changes were revisions to the calculation used to determine the taxpayer’s future income for those applying for an Offer in Compromise; an expansion of the Allowable Living Expense guidelines when determining a taxpayer’s ability to pay; and the inclusion of delinquent student loans, state and local taxes in an Offer in Compromise.

Impact on Collections Actions

The Fresh Start Program and its subsequent revisions have had a dramatic impact on the number of taxpayers who are targeted for collections actions.

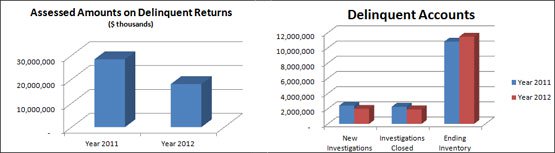

According to the 2012 Internal Revenue Service Data Book, the number of delinquent taxpayer accounts increased from 10,809,000 in 2011 to 11,460,000 in 2012. A 6.1 percent increase in the number of delinquent accounts doesn’t necessarily mean that more people are failing to pay their taxes. Instead, it suggests that the IRS is relaxing its efforts to pursue collections actions against delinquent taxpayers.

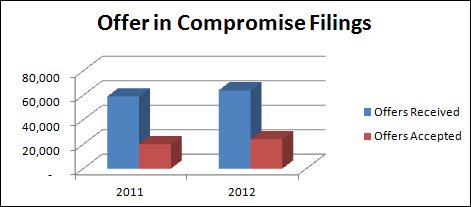

While more accounts became delinquent between 2011 and 2012, more taxpayers were able to take advantage of an Offer in Compromise due to the streamlined eligibility guidelines. In 2011, the IRS received approximately 59,000 offers but accepted just 20,000. In 2012, the number of offers submitted increased to 64,000 and the number of offers accepted jumped to 24,000, which represents a 20 percent increase. Overall, the total acceptance rate went up four percent and the IRS received approximately $41 million more in revenue through Offers in Compromise over 2011.

Lien & Levy Enforcement

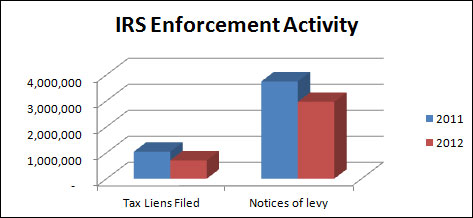

The IRS also modified the threshold limits for filing federal liens from $5,000 to $10,000 in 2012. The IRS still has the power to enforce a lien on amounts less than $10,000 but only when circumstances warrant it. These changes resulted in a significant decrease in the number of taxpayers who were targeted for liens. In 2012, the number of tax liens filed totaled 707,768, which represents a 32 percent decrease over the 1,042,230 liens filed in 2011. Approximately 2,961,162 notices of levy were served, compared to 3,748,884 for the previous year, which represents a 21 percent decrease overall.

What It Means for Taxpayers

The Fresh Start Program provides relief for taxpayers who are concerned about owing back taxes owed to the IRS. Since the program was expanded in 2012, it’s become even easier for individuals and businesses to negotiate payment of their outstanding taxes without fear of a lien or other collection actions. If you owe back taxes, don’t be afraid to contact the IRS to find out how the Fresh Start Program can benefit you.

Leave a Reply

You must be logged in to post a comment.