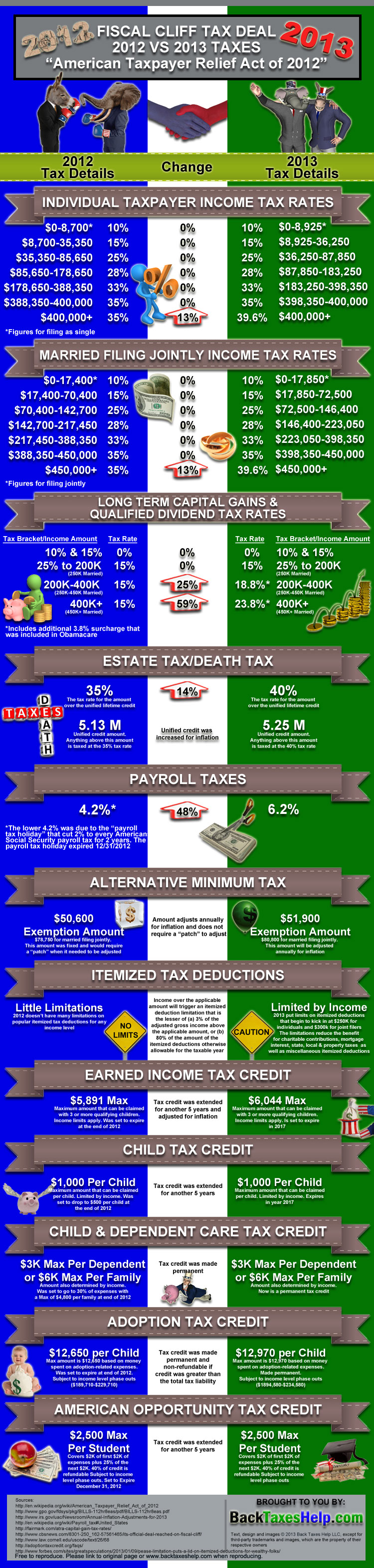

After all of the hype about the Fiscal Cliff, the House passed the American Taxpayer Relief Act of 2012 (ATRA) and President Obama signed it into law. At the end of 2012 many tax provisions that were temporarily set up to keep taxes lower were set to expire. With the passage of the ATRA, many of the feared tax effects of the fiscal cliff were eliminated.

ATRA made in many tax changes which include revising tax rates on ordinary income and investment income, modifying the estate tax rate, making permanent multiple tax provisions that had expired, extending multiple tax provisions that ended and changing a few other aspects of the federal tax code.

Below is a visual comparison of the tax law before and after the passage of the ATRA. The left column shows what the law was in 2012, the right column shows the tax law for 2013 and the middle column is the negotiated change. (Click the image below to enlarge)

Leave a Reply

You must be logged in to post a comment.