Michigan Tax Relief: Guide to Resolving MI Back Tax Problems

- Possibly Settle Back Taxes for Less

- Stop Wage Garnishment and Bank Account Levy

- Remove IRS & Michigan State Tax Penalties

- Stop Michigan & IRS Tax Liens

- Settle Payroll Taxes

- File Delinquent Michigan & IRS Tax Returns

- Connect with a team of Tax Attorneys & CPAs

- Help with Michigan & IRS Audits

- Receive Free Consultation & Likely Outcomes

- Receive Free no Obligation Competitive Quote

The Michigan Department of Treasury (DOT) is responsible for enforcing the tax laws in the state of Michigan for individuals and businesses. Like the IRS, DOT is committed to providing troubled taxpayers various ways to get back into compliance with the state of Michigan.

If you received a notice from the Michigan Department of Treasury stating that you owe back taxes or know you will not be able to pay taxes in full when you file, you need to be aware of what your options are. Below is some information on how the DOT collection process works and some of the options that are available to get into compliance with the Michigan tax laws, even if you cannot pay your taxes in full.

Michigan Tax Collections Process

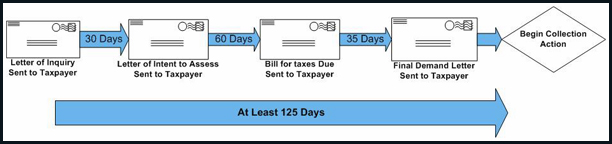

Taxpayers who owe taxes to the state of Michigan have at least 125 days from the date that the initial letter is sent to when they will take collection actions. This does not mean that you are totally safe for these 125 days because they will continue to charge penalties and interest to the unpaid tax balance once it is assessed. Below is a graphic that is provided by the Michigan DOT on their collection process.

Michigan Installment Agreement

After you receive a bill for taxes due (Form 168 or Form 169) the Michigan Department of Treasury may consider you for an Installment Agreement if your financial situation meets their specific qualifications. All installment agreement requests are reviewed and if approved the DOT will decide on a minimum monthly payment amount that must be paid monthly and if denied, they will send instructions on how to proceed.

Applying for an Installment Agreement

- Agreements 24 months or less: It is required to fill out Form 990 (Michigan Department of Treasury Installment Agreement Form). Once the form has been completed you must mail it to the address that is on the front of the notice you received which stated the tax amount owed.

- Agreements over 24 months: It is required to fill out Form 990 as well as a collection information statement which lists your income, expenses, assets and liabilities. In order to obtain the collection information statement you must contact the Collection Division to request the form.

Contacting the Collection Division

Mail:

Collection Division

Michigan Department of Treasury

P.O. Box 30199

Lansing, MI 48909-7600

Phone: (517) 636-5265

Don’t Agree With a Bill? Appeal Information

If you received a bill for taxes that you do not agree with it is important that you get in contact with the Michigan DOT to support your claim. To do this you must respond to them with the following information:

- Write a letter that explains why the assessment is not correct and include documents that support your reasons that are given in your letter. In the letter, be sure to include your account number which is either your social security number or tax identification number.

- A copy of the notice you received from the Michigan Department of Treasury

- Mail the information to the address that you received on the tax bill.

Helpful Michigan Department of Treasury Contact Information

Need more information on a particular tax problem you are having? Below is contact information for various departments within the Michigan DOT. When calling, be sure to have your tax documents available as well as your SSN # or EIN #.

Billing Information Contacts

- Income Tax: (517) 636-4486

- Sales, Use and Withholding Tax: (517) 636-4730

- Single Business Tax: (517) 636-4700

- Michigan Business Tax: (517) 636-4657

Pay Back Taxes or questions about your account

- Treasury Collections Division: (517) 636-5265

Getting Professional Help to Resolve Your Michigan & IRS Tax Problems

BackTaxesHelp.com is one of the premier tax resolution sites serving Michigan, offering tax solutions for every individual’s unique financial situation. We created a strong and diverse team of tax professionals who will settle, file, reduce and resolve State and IRS taxes. All of our tax professionals will provide you with a free consultation to give you your options and likely outcomes.

Our Simple Tax Relief Process

2

No Obligation!

Understand How You Can Settle, Save, and Resolve Your IRS & State Taxes

3

Save Time!

Decide If You Want To Resolve Your IRS Taxes Using Our Tax Experts

Michigan Tax Professional

Fill out the form below or call 1-800-928-5035 to receive a free consultation from a tax specialist. Connect with a tax attorney, CPA, enrolled agent or another tax professional for your unique tax situation.