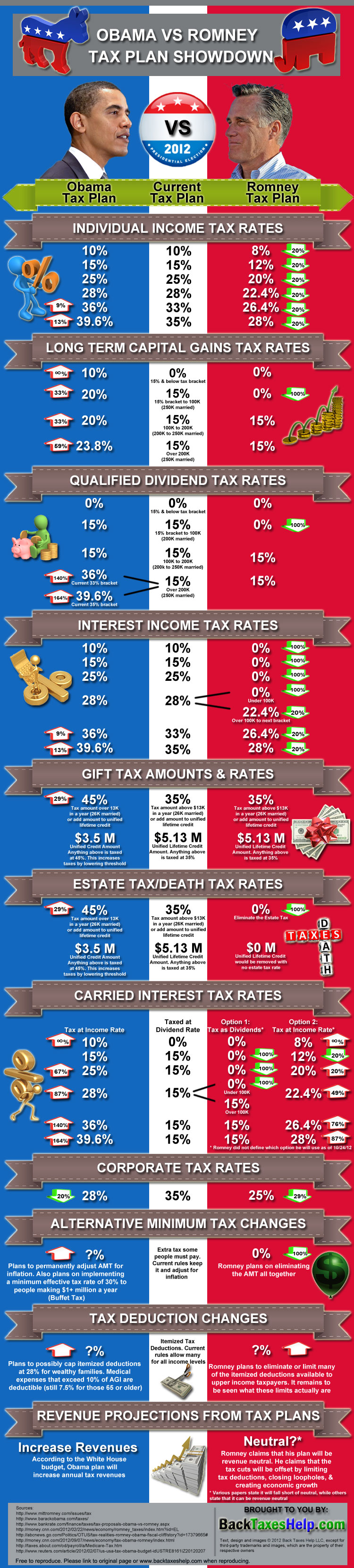

With the Presidential election on the horizon, Barack Obama and Mitt Romney have put forth their ideas to reform the current tax system. Both candidates have different ideas of how to achieve an optimal tax plan that is fair for US taxpayers, less complex than the current system, and fiscally sound.

Below is a visual comparison of the tax changes that the two major candidates are proposing if elected into the next term as President of the United States. With Mitt Romney’s plan, certain details remain to be seen. However, below is our best effort of a visual comparison between both candidates’ tax plans based on current public information. (Click image below to enlarge)

Do not find middleclass tax change for mortgage interest deduction,

increased deductions for prescriptions or lab tests, health insurance

premium, or local, state fees indiscriminately assessed on property.

Please send deduction details for 2013 for mid-income deductions and

AMT.

thanks, Nanna

This is great. The real question is whether romney’s plan will be revenue neutral.

If you believe this, I have a bridge to sell you.

Marlarkey comes to mind too! 🙂

the feds bring enough income . That’s not the real issue. I pay my taxes, i have no problem paying them . The issue is spending, it must come down. You cant keep spending and borrowing money you dont have, and wont for the next 100 yrs

@JudyLindenberger

Believe what exactly. This is essentially the tax plan of the two candidates. Romney does want to cut taxes but cutting taxes isn’t always a good thing. Their positions on taxes are easily verifiable so what exactly are you questioning?

@don

No the issue is a combination of spending and low revenues. There are essential services that an advanced society provides to its people. There will always be spending, and a lot of it, in an advanced society. People who think it is only a spending issue are entirely out of touch.

Especially during an economic downturn spending should not be the issue. The issue should be the creation of jobs. Which have been created by the millions through government spending in the past. And afterwards more tax revenue is created and more money is spent in the economy, econ 101. That is not to say the private sector doesn’t create jobs, of course it does, but people who say government doesn’t create jobs, Mitt Romney, missed history class.

It has been a “conservative” lie that they are concerned about spending and fiscal issues. These are the people who have spent and spent and spent, all the while cutting taxes because they believe that rich people create jobs, this isn’t fiscally responsible. Rich people do not create jobs, demand creates jobs, econ 101 again. And how do we increase demand? By a strong middle class. And you create a strong middle class by investing in education, investing in infrastructure (which creates jobs), cutting taxes for the middle class (not the extremely wealthy), providing affordable health care, etc.

The issue is far more complicated then, “it’s just spending, its too high”. That is true but revenue must be at a level that is balanced across the population and does not benefit a particular *class* more than another. Also spending must come down in a reasonable manner, after the economy gets back on track, in a way that does not hurt the middle class or the vulnerable in our society.

Ayn Rand was an idiot

Pretty picture but about as meaningless as all the rhetoric. What people want to know is how this will impact them. Let’s assume your numbers are right and run the math on a typical middle class family. Our hypothetical family makes $100,000 pays $20,000 in mortgage interest, pays tithing of $10,000, makes other charitable contributions of $5,000 and pays $3,000 in state and property taxes. Under the presidents plan the y have$62,000 in taxable income. Lets say that puts them in the 15% bracket on the presidents plan which is pretty close. The pay $9,300 in federal taxes. Romney has been throwing around a $17,000 figure as a cap for all deductions. This leaves our family with $83,000 in taxable income. If they end up on the same line on Romney’s side of your picture they pay 12% or $9,960 in taxes. So the middle class gets hurt but the more money you make the more you save because of his lower rates. I think this is why Romney refuses to give us any details.

How about a capital gains tax of 100% if your investment sends good American jobs over seas and does not replace them with equal or better jobs. That would have eliminated

all the profit Bain Capital made.

There has got to be a combination of increased revenue and expendatures for major capital projects to get the econonmy going. The low to middle class do not have the income to absorbe either increased taxes nor reductions in their deductions. The wealthy have been hording their money since the Bush tax cuts took place and have been reaping the benefits from a growing stock market.

Tax increases on the upper 10%, an increase on cap gains, div and interest for the upper 30% combined with a major infrastructure improvement program will get the economy going and will not cause further defecits.

Sounds very similar to what Obama has been trying to do over the past 3 years.

You seem to have purposely both ignored some numbers and fudged some others. Whether Romney’s plan puts a 17 or 25k cap on deductions, the middle class will get their heads handed to them. What is even worse, it will absolutely kill the housing industry. Why buy a house, particularly a new house. Of course, in the long run, investors will build and buy rental units, since the taxes will be lower. That would completely change the culture in this country. No one will feel as though they have a piece of the pie.

As far as being revenue neutral, I’m more than a little dubious. Also, which services do you want to give up? That is what it amounts to.

@michael13ov. You state, “Especially during an economic downturn spending should not be the issue. The issue should be the creation of jobs. Which have been created by the millions through government spending in the past. And afterwards more tax revenue is created and more money is spent in the economy, econ 101.” Could you point out to me, an individual that has advanced degrees in both history and economics… as well as a few other areas of study, when this has ever occurred? In all actuality, you can’t… because this is historically inaccurate.

Even during the New Deal, heightened spending and taxation caused job loss… not job growth. The only thing that ended the Great Depression was the fact that our factories began selling war machines, supplies, rations, etc to our eventual allies… and even some to our eventual enemies. This continued as men entered the military to fight the war and women entered the factories to keep things going. Once the war ended, Truman tried to return to FDR’s economic strategies… and nearly threw us into another Great Depression. The country was far too over taxed, over spent, and over regulated.

What changed this, oh he who does not know history but claims others missed history class? Eisenhower won in 1952, and immediately cut taxes, spending, and regulation. Thus we had the booming fifties. Despite cuts in taxes and spending, he managed to modernize the nation’s infrastructure. Imagine that… he cut the BS out of the budgets, and focused on the necessities. That created heightened economic activity… which resulted in higher tax revenues.

John Kennedy suffered an almost immediate loss of economic activity when he succeeded Eisenhower. His initial budgets were high in spending, and he raised taxes in 1961. In 1962, he reduced taxes to a slight bit below where Eisenhower had set them… and he had an economic boom that lasted until a year after his death. Higher revenue was obtained by the IRS, and Kennedy’s social programs were paid for. Johnson screwed the pooch. He raised taxes across the board, and set a penalizing tax rate on the rich. He also tripled spending beyond any previous Administration in US history. He called this the “War on Poverty”. On top of this, he heightened spending on Vietnam each and every year of his presidency. Revenue dropped to nearly the same levels as FDR’s reign (which were the lowest per capita of the 20th century)… and his spending was nearly out of control. Economic activity stagnated for a couple of years, then died. This trend continued through Nixon and deepened with Carter.

In 1981 Reagan put forth the largest tax cut in American history. He was also facing a worse crisis than Eisenhower had… and worse than what Obama is today (nonetheless in 2009). By 1983, he also cut spending by 15% across the board… except for his Star Wars initiative (which won the Cold War… and set up the tech boom of the 90s… but created the beginnings of the deficits we have today). By 1983, America saw the greatest spike in economic activity in the history of the world. It lasted until the early 90s when George HW Bush rose taxes and doubled down on spending. All time record highs in tax revenue per capita were had, and overall revenue levels that all of his predecessors could only dream of.

Even Bill Clinton cut taxes in 1994, and that got the government out of the way to allow the tech companies that Reagan had set to grow through defense spending to create Clinton’s economy. This remained in place until Clinton rose taxes in 1998. The economy flattened, and by the time W took office in 2001, we were in 2 years worth of recession. W cut taxes, and despite the world’s worst terror attack, two wars, and steeply rising unemployment that began in June of 2000. The US economy boomed in 2002, and that was upheld until Dems too both the House and Senate in 2006… and began over regulating most sectors of the economy. W also spent like a drunken sailor trying to impress some girl at the bar. This hurt tremendously by adding to the deficit. The higher the deficit, the less value our currency holds.. the more revenue it takes to cover basic spending, nonetheless everything else.

Sorry, but history and proven economics are not on your side here. The basic idea behind tax cuts is that if you keep the money in the hands of the consumers… they will spend more. If they spend more, it creates more economic activity. With higher economic activity, you create more new jobs in just about every sector of the market place. When you create more jobs, you have more people earning revenue. When you have more people earning more, you have more people paying taxes. When you have more people paying taxes, you have higher tax revenues…. despite reducing tax rates. It has worked every single time it’s been implemented in every place it’s been implemented.

Spending does need to be cut, but you can only cut so much. There is a lot of pork that can be removed, and a lot of foreign aid programs that should either be cut or done away with until we get our own ducks in a row. Do this, and you’ll begin to cut the deficit and return the value of our currency. Then, cut taxes. Unfortunately, the liability is so great now that we do need to keep taxes in place as they currently are. Raise taxes on anyone right now, and this economy dies.

8. MDL

Your example of how the comparison of Obama and Romney’s tax plan affects tax payers…Lets use your assumptions to be correct….Under Obama $100,000 income – $20,000 Int – $10,000 Charity – $5,000 ther Charity and – $3,000 State and Property taxes = $63,000 taxible Income X 15% = $ 9,450.00 Taxes

Now under Romney, the same $100,000 income – $17,000 deduction to use any way you want = $83,000 X 20% (you forgot that he went to a higher bracket) = $16,600.00.

So yes, the middle class gets hurt to the tune of $7,150.00 under Romney’s plan….Don’t worry, I make mistakes also.

@MDL & @c.Waynw Richard

One thing I would also like to point out is that Mitt Romney didn’t say the $17K figure on deductions is what they will actually use. That was the low end of the examples he used, he also mentioned $25K and $50K.

Even if the deduction amount does turn out to be 17K, I don’t believe that would impact many middle class families. The example given contains very high deduction amounts for a family earning 100K a year.